Полная версия:

Все науки. №2, 2024. Международный научный журнал

23. Paryev E. Ya. Towards clarifying the possibility of observation of the LHCb hidden-charm pentaquarks Pc+ (4312), Pc+ (4337), Pc+ (4440) and Pc+ (4457) in near-threshold charmonium photoproduction off protons and nuclei. Nuclear Physics A. Volume 1029. 2023. No. 122562.

24. Alayafi Hassan Ali, Alruwaili Mubarak, Aljumah Talal Khalid, Alshehri Alid, Alrasheed Deema, Alanazi Muhannad Faleh AlRuwaili, Raed, Ali Naif H., Albarrak Anas Mohammad, AlRashdi Barakat M., Taha Ahmed E. Mycoplasma pneumoniae and Schistosoma mansoni co-infection in a young patient with extensive longitudinal acute transverse myelitis. Journal of Infection in Developing Countries. 2022. Volume 16, Chapter 12, 1933 – 1938 pp.

25. Pelloni Sandro, Rochman Dimitri. Adjustment of JEFF-3.3 data for U-235 and Pu-239 in the fast, non-resonant energy range. Annals of Nuclear Energy. Volume 177. 2022. No. 109296.

26. Liu Fu-Long, He Chuang-Ye, Wang Hao-Ran, Bo Nana, Wu Di, Ma Tian-Li, Yang Wan-Sha, Wei, Ji-Hong, Wang Zhi-Qiang, Liu Yi-Na, Song Ming-Zhe, Liu Yun-Tao. Thick-target yield of 17.6 MeV $\gamma$ ray from the resonant reaction 7Li (p, γ) 8Be at Ep = 441 keV. Nuclear Instruments and Methods in Physics Research, Section B: Beam Interactions with Materials and Atoms. 2022. Volume 529, 56 – 60 pp.

DEVELOPMENT OF PRICE ACTION PREDICTION ALGORITHMS IN PYTHON

UDK: 510.9

Xolmatova Nilufarxon Jahongir qizi

Student of the TUIT xolmatovan44@gmail.com

Abdurasulova Dilnoza Botirali kizi

assistant of the Fergana branch of the TUIT

abdurasulovad1@gmail.com

Abstract. This article explores the development of advanced price action prediction algorithms using Python. The study focuses on employing machine learning techniques to forecast future price movements in financial markets. Through extensive backtesting and evaluation, the effectiveness of these algorithms is assessed. The implementation is carried out in Python, utilizing popular libraries such as Pandas, NumPy, and Scikit-learn. The research aims to contribute to the field of algorithmic trading by providing insights into the design and performance of predictive models for price action.

Keywords: Algorithmic trading, Price action prediction, Machine learning, Python, Financial markets.

Introduction

In the rapidly evolving landscape of financial markets, algorithmic trading has gained prominence. This section discusses the significance of price action prediction algorithms and their role in facilitating informed trading decisions. It also outlines the objectives of the study, emphasizing the need for accurate and reliable forecasting models. The introduction provides a contextual background on algorithmic trading and the challenges associated with predicting price movements.

Literature Review and Methodology: This segment delves into the existing literature on algorithmic trading strategies and price prediction models. A comprehensive review is conducted to identify key approaches and methodologies adopted by previous researchers. The methodology section details the data collection process, the choice of features, and the machine learning algorithms employed. The rationale behind the selection of Python as the programming language is also elucidated.

Razin S.A.’s article» Что должен знать разработчик на языке python, работая в сфере data science» states the following points: Machine learning is another field of computerization development. Its main task is the computer’s ability to learn to recognize faces, voices, select pictures or movies on YouTube, taking into account the user’s previously watched videos. That is, it should not work only using pre-written code. [1]

Machine learning is another area of computerization development. Its main task is the computer’s ability to learn to recognize faces, voices, select pictures or movies on YouTube, taking into account the user’s previously watched videos. That is, it should not work only using pre-written code. Разин Сергей Александрович

Anupa S. Dash, Ujjwal Mishra’s article ” Sentiment Analysis Using Machine Learning for Forecasting Indian Stock Trend: A Brief Survey» the above results are quoted. [2]

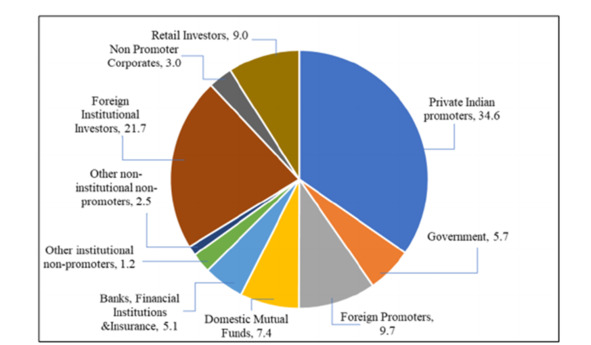

Fig. 1.Types of Investors Holding in Percentage the Ownership of NSE-Listed Companies as of December 2020 [1]

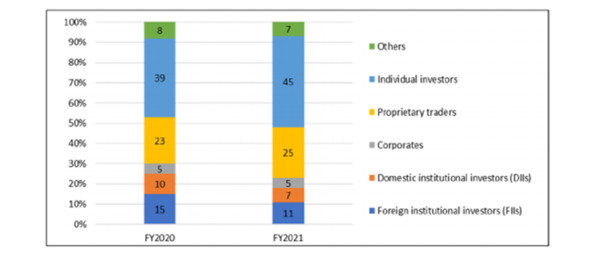

Fig. 2. Types of Investors Participate in the Capital Market at NSE (in %) [2]

The movement of the price of a particular stock can behave the same way for a few days, a few weeks, or even months based on demand and supply.

The direction of price movement is termed a trend. The trend can be upward or downward. An upward trend is formed when the price movement makes higher swing highs and higher swing lows. A downward trend is formed when the price movement makes lower swing lows and lower swing highs. The trends are measured for the short-term, medium-term or intermediate-term, and long term. The short-term trend can be the price movement in the same direction for a few days to a few weeks; the medium-term trend can be the price movement in the same direction for a few weeks to a few months; and the long-term trend can be the price movement in the same direction from a few months to a few years.

Конец ознакомительного фрагмента.

Текст предоставлен ООО «Литрес».

Прочитайте эту книгу целиком, купив полную легальную версию на Литрес.

Безопасно оплатить книгу можно банковской картой Visa, MasterCard, Maestro, со счета мобильного телефона, с платежного терминала, в салоне МТС или Связной, через PayPal, WebMoney, Яндекс.Деньги, QIWI Кошелек, бонусными картами или другим удобным Вам способом.

Вы ознакомились с фрагментом книги.

Для бесплатного чтения открыта только часть текста.

Приобретайте полный текст книги у нашего партнера:

Полная версия книги

Всего 10 форматов