Полная версия:

Management practices of Russian companies. Vol.2

Коллектив авторов

Management practices of Russian companies. Vol.2

Recommended for publication by the Academic Council of the Graduate School of Business, https://elibrary.ru/hrbxqi National Research University Higher School of Economics

Reviewers:

S. Starov, PhD, Professor, Department of Marketing, Graduate School of Management, Saint-Petersburg State University;

V. Evseev, PhD, Executive Director, Association of Managers

Authors:

M. Akim, V. Boltrukevich, E. Buzulukova, L. Cheglakova, A. Demin, M. Dvoryashina, A. Gabrielov, N. Guseva, S. Kiselev, M. Maron, G. Minnigaleeva, Y. Morozov, U. Podverbnykh, N. Pushkareva, S. Smeltsova, I. Tsarkov, T. Vetrova, O. Zelenova

Edited by

S. Kushch, Doctor of Sciences, Professor, Deputy Dean for Research,

HSE Graduate School of Business

© National Research University Higher School of Economics, 2022

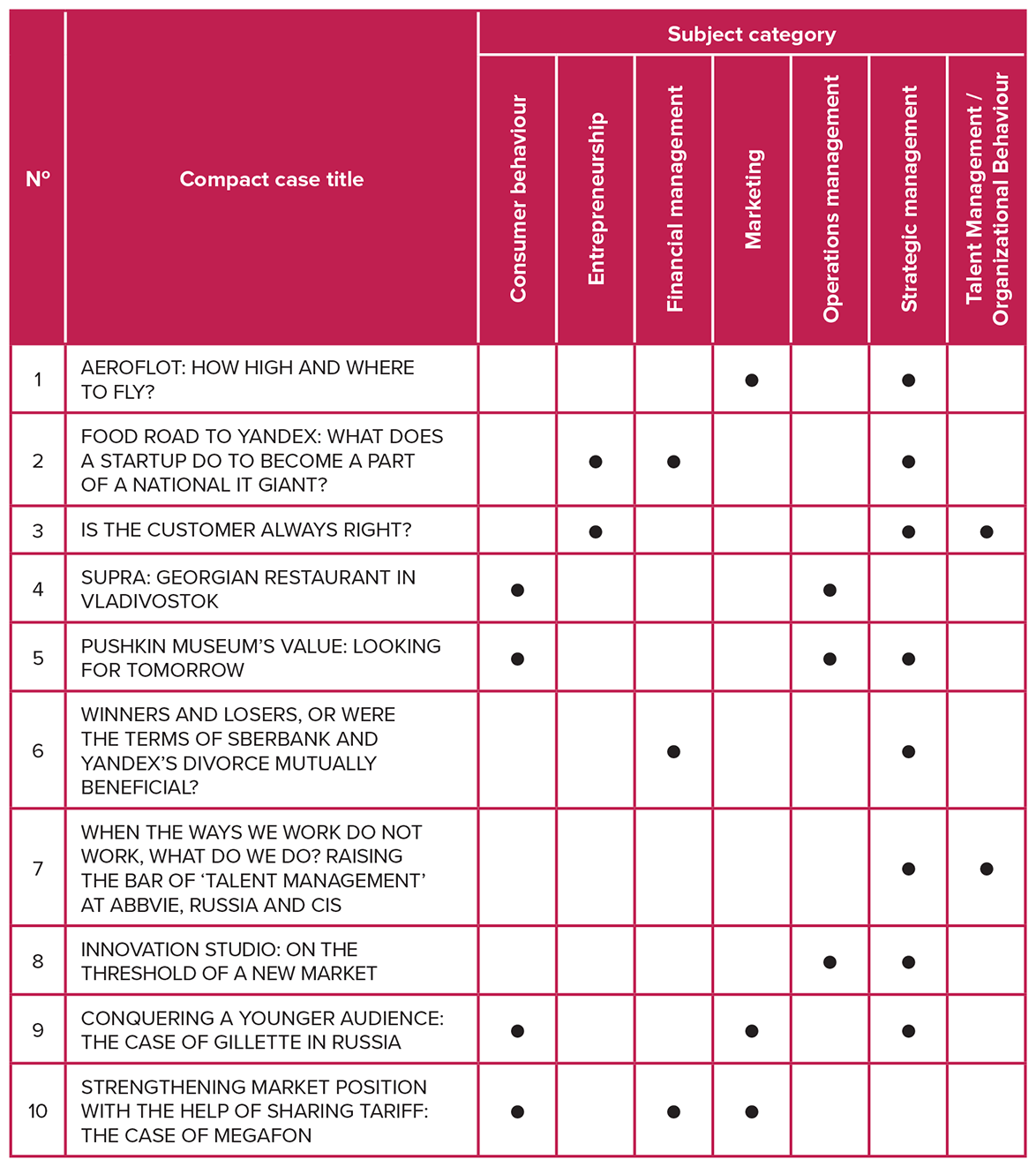

* * *COMPACT CASES DISTRIBUTION BY SUBJECT CATEGORIES

INTRODUCTION

SERGEY KUSHCH

Professor, Deputy Dean for Research, HSE Graduate School of Business

Dear Readers!

You are holding the second volume of cases from the HSE Graduate School of Business, produced as a part of a large-scale project of creating a collection of cases that reveal the specifics of doing business in Russia. We tried to diversify the collection by including cases, which describe the challenges of various areas of modern management theory and practice, such as business process optimization, talent management, digitalization of business models, building the development of social networks, consumer behavior management.

The HSE Graduate School of Business continues the practice of involving professors from different departments in the development of educational cases. The second group of faculty members has already been trained in desinging and writing educational compact cases. Moreover, it is especially encouraging that not only the representatives of the pedagogical staff, but also the university researchers are involved in the development of these cases.

The case method as an educational method is gradually taking up one of the leading roles in teaching business disciplines in Russia. Realizing this trend, we strive not only to develop educational cases, but also to strengthen the competencies of our professors in using cases in the educational process. All the cases included in the collection were tested either on basic educational programs or on leader training programs.

The ten study cases that make up this collection consider challenging situations in management through the prism of different subject areas of science.

Thus, three cases are devoted to the choice of strategic alternatives in present turbulent business environment. The “Aeroflot: how high and where to fly?” case is focused on the issues of strategic management in conjunction with marketing, when one of the most famous Russian brands is faced with the task of developing a new strategy in ever-changing, volatile environment. The “Is the customer always right?” case emphasizes the difficulty of having a personal brand for a recruiter when recruiting for a third-party company. The “Winners and losers, or were the terms of Sberbank and Yandex’s divorce mutually beneficial?” case allows you to dive into the specifics of strategic transactions in detail, considering various methods for estimating the company’s value.

Three other case studies focus on consumer journey research. Moreover, each case of this group is focused on a separate specific industry. Thus, the “Supra: Georgian restaurant in Vladivostok” reveals the specifics of the restaurant business, the “Pushkin Museum’s value: looking for tomorrow” case reflects the specifics of the work of museums, and the “Conquering a younger audience: the case of Gillette in Russia” focuses on the changing market, which has undergone significant changes during the COVID-19 pandemic. Two cases reflect the structural changes in the company when deciding to radically switch its business model. The authors of the “Food Road to Yandex: What does a startup do to become a part of a national IT giant?” case highlighted the typical challenges faced by aspiring entrepreneurs in the process of large businesses acquiring assets all around the world, also emphasizing the specifics of the Russian market. Other aspects of studying the structure of a company are considered in the “Innovation Studio: on the threshold of a new market” case, where the main task of the company is to enter new markets.

One of the cases reveals the specifics of the company’s internal processes. `The “When The Ways we work do not work, what do we do? Raising the bar of `Talent Management’ at AbbVie, Russia, and CIS” case reflects the issues of changing the company’s business strategy driven by the need to revise the talent management system.

All cases included in the collection are designed in accordance with international standards and with the support of experts from The Case Centre. In November 2021, the HSE Graduate School of Business launched its own collection of case studies based on the international The Case Centre platform. The collection is dedicated to the experience of management of Russian companies and transnational corporations doing business in Russia. The cases of this collection will also be registered in the near future and will be available on The Case Center platform.

The collection was developed for professors, students and business schools participants, as well as for managers interested in understanding both the specifics of modern Russian business and the management mechanisms of transnational companies operating in the Russian market.

I wish to express my gratitude to the authors of the cases, partners and company representatives for their contribution to the development of the case method at the Graduate School of Business at the Higher School of Economics. I look forward to our continued cooperation!

Case № 0011-2-1

AEROFLOT: HOW HIGH AND WHERE TO FLY?

N. Guseva, M. Dvoryashina

The case study is developed for the Bachelor’s and Master’s degree students as well as for MBA and EMBA programme participants in the fields of Strategic Management, Strategic Thinking and Management, Corporate Governance, Strategic Marketing, etc. The case study is based on open-source information about the most internationally recognised Russian brand, the Aeroflot Group.

The case provides an opportunity to analyse a set of issues related to the development of a corporate strategy, its transformation into competitive and functional strategies with a particular focus on the development of marketing strategy, as well as the issues related to the implementation of these strategies in a highly turbulent business environment caused by the pandemic of COVID-19.

Andrey Panov, deputy director for strategy and marketing at Aeroflot Group, took his eyes off the quarterly financial report prepared by his colleagues and went to the window. The noise of plane turbines taking off and landing is a constant background noise for the employees of the Sheremetyevo airport office. But now, it was unusually quiet in the company’s office. In the spring of 2020, most of the Aeroflot Group’s air fleet had been grounded amid quarantine restrictions, and the planes that were taking off to the skies had significantly reduced their daily flight hours. With almost no revenue from passenger traffic, unconventional solutions were required.

SUMMER 2020: FIRST RESULTS

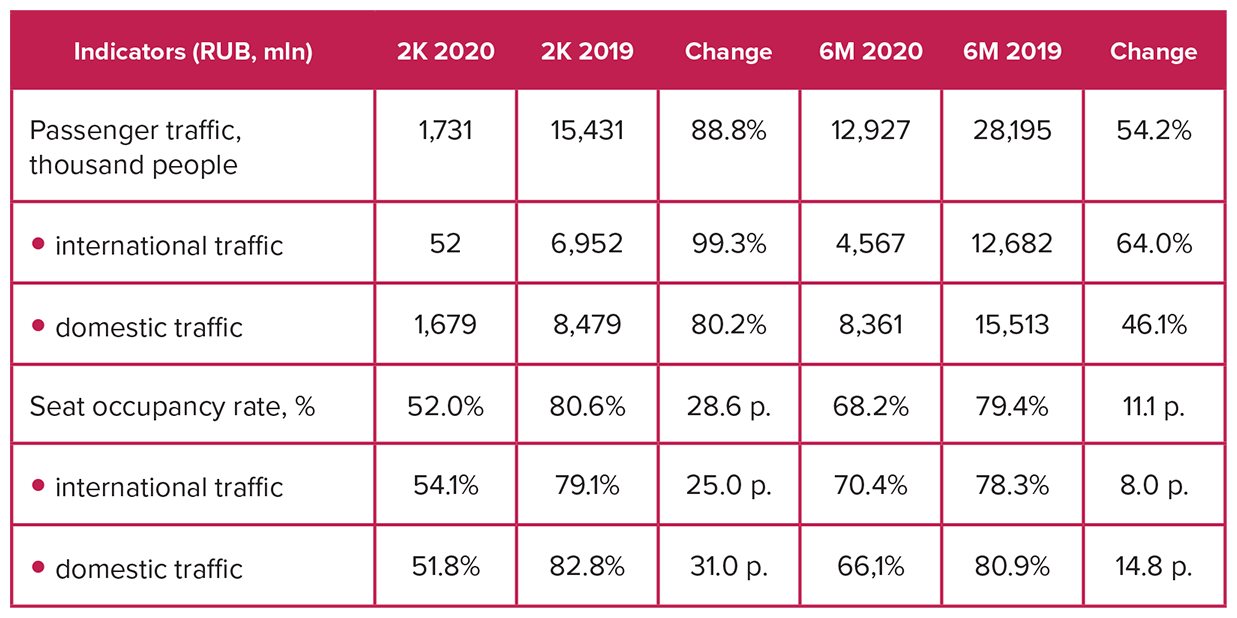

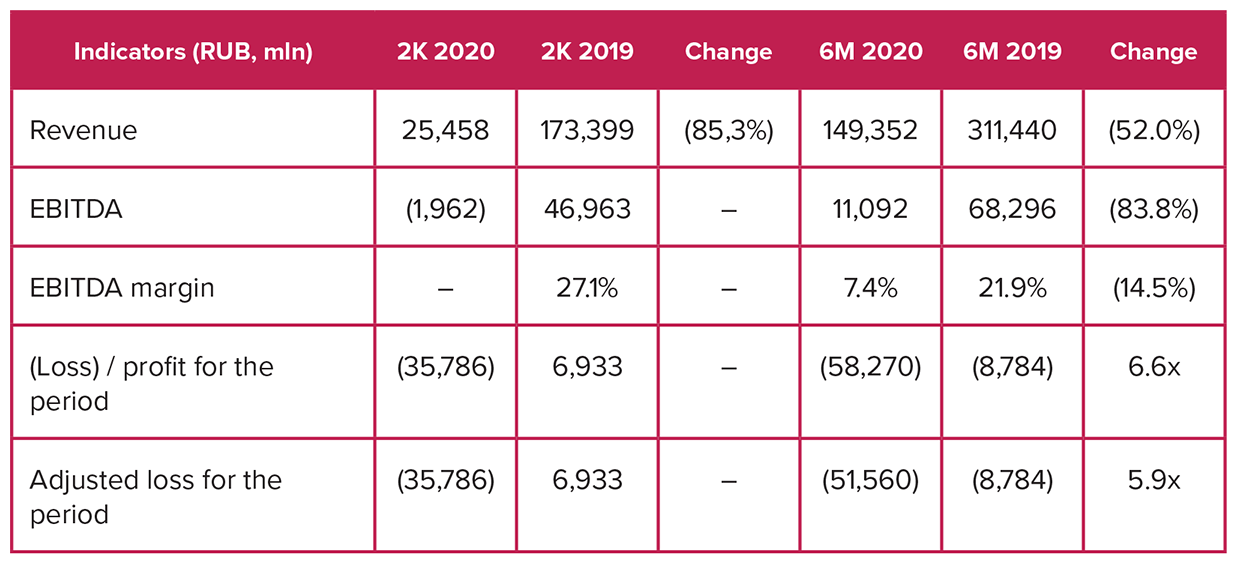

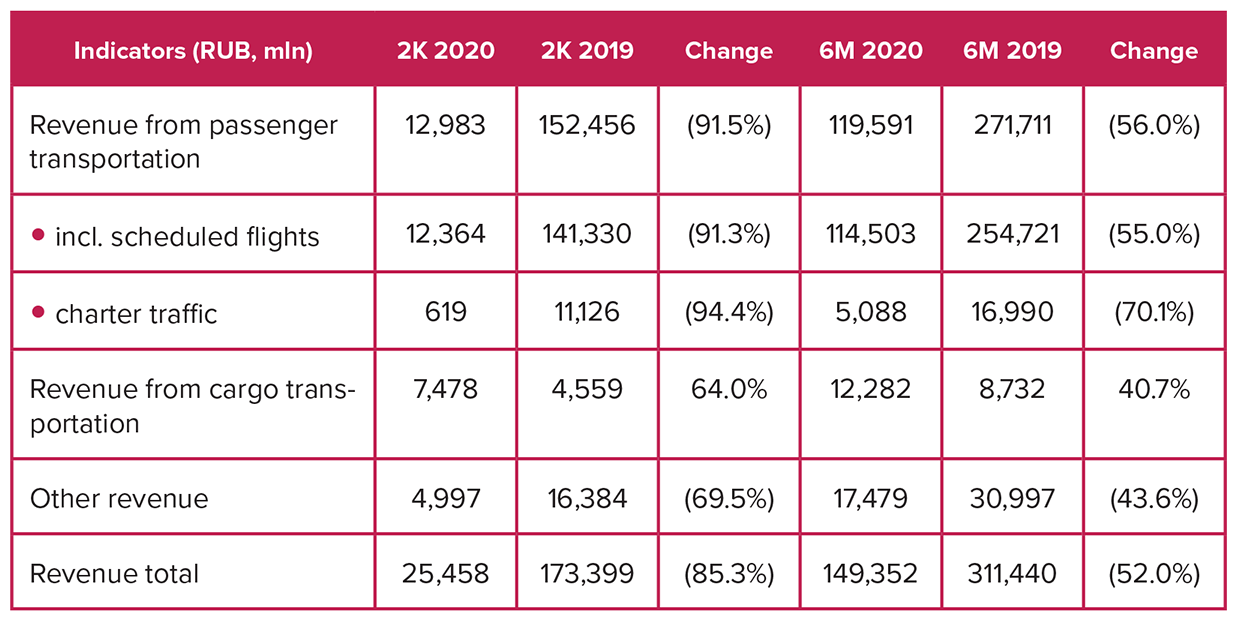

The professional airline community is debating market options, depending on the development scenarios and the depth of the pandemic’s negative impact on the industry. The world is undergoing tectonic changes, and once the crisis is over, it will be less about restoring the business to its former form and more about transforming it into something new. Aeroflot’s key results for the first six months of 2020 (Appendix 2) show that the company’s strategy, approved in 2018, needs to be adjusted.

The pandemic has disrupted well-established management systems. Decades-old demand and pricing models for passenger transport services no longer fit the new pandemic realities, causing a drop in airline revenues. As a result of this adverse financial development, a package of strategic solutions will be discussed today at Panov’s meeting with consultants from Bain, Aeroflot’s long-standing partner in developing strategic business development programmes.

CHANGE OF FLAGSHIP?

In Aeroflot Group’s previous strategy, the main member of the group was Aeroflot Airlines, whose fleet comprised medium-haul and long-haul, including intercontinental, aircraft. Aeroflot Airlines positions itself as a premium carrier. As the global trend shows, the premium segment will continue in the new post-COVID environment, but it will not grow as fast as the low-cost segment. The overall market tendencies and especially its business travel segment are changing. Companies are reluctant to buy business class tickets on short flights, the number of business trips have decreased as negotiations move to an online format, and the incomes of potential individual consumers in a pandemic are decreasing.

INCREASE POBEDA SIXFOLD

At the core of the suggestions made by Kate Cook and Trevor Geitz – consultants from Bain, an international strategic consultancy, is a proposal for the low-cost airline Pobeda of the Aeroflot Group to transfer the main routes (medium-haul) currently served by Aeroflot to Pobeda. Currently, the low-cost carrier has only 30 aircraft in its fleet. According to one of the scenarios developed by Bain consultants, Pobeda will carry 55–65 million passengers a year by 2027–2028. This is six times more than it was in the pre-crisis 2019, when the company served 10.3 million people. Accordingly, Pobeda’s aircraft fleet should grow to 170 aircraft.

The consultants’ calculations show that Aeroflot’s projected total annual traffic of 130 million passengers by 2028 corresponds to the level of the entire Russian civil aviation industry for 2019 (128 million passengers). The expansion of Pobeda’s operations in Russia’s domestic market will result in a 30 % reduction in economy class fares. This will certainly not make their competitors happy, Panov thought. Trevor also stressed that the new domestic routes for Pobeda, which have low margins, are likely to be affected by the new trend of reduced business class travel in the short-haul segment. All of this has the potential to exacerbate the industry’s recovery from the pandemic. The risks of increased competition on domestic routes that Pobeda would enter were decided to be worked out in more detail at the next meeting.

Aeroflot, which ranked first among Russian airlines in terms of passenger traffic in 2019 (37.2 million passengers), should focus on routes with high demand for business class (e.g. Paris, London, Geneva, Zurich) and long-haul routes (e.g. Lisbon, Madrid), as suggested by the consultants. Estimates of passenger traffic for Aeroflot should remain at the same level of 35–40 million passengers per year.

HOW TO DIVIDE THE SKY?

Aeroflot’s main competitors in Europe are its SKY Alliance TEAM partners – Air France-KLM,[1] Europe’s largest airline group, and Lufthansa Group,[2] representing the Star Alliance network.

Andrey was familiar with Carsten Spohr, the head of German airline Lufthansa, who became the chairman and chief executive of the company in May 2014 and Benjamin Smith, a Canadian businessman and Air France-KLM executive who took over in 2018. Prior to that, Benjamin was president of Air Canada and its chief operating officer. Both Carsten and Benjamin are recognised professionals in the management of major airlines. All three have met many times at IATA venues (International Air Transport Association).[3]

Andrey reflected on how the new strategy should take into account the specifics of the competitors’ anti-crisis activity and what measures to strengthen the competitive advantage, both on domestic and international routes, are likely to be proposed by consultants.

RESTARTING THE AIR STRATEGY

Once the board has approved the new strategy, it will need to work extensively to agree the new agenda with all stakeholders, break down the goals and KPI and communicate them to all members of Aeroflot group. For each budget figure, convincing arguments, calculations, assessments, and proposals for organisational change will be required.

Going into the meeting with Kate and Trevor, Andrey reflected that today’s meeting on key changes to Aeroflot’s strategy was crucial, but only the first step on the road to new goals. What will this first step be, how high can and should Aeroflot fly in the long term, and which new destinations should form the basis of the sustainable development of the company, one of the world’s leading air carriers?

NATALIA GUSEVA

Professor, Department of Strategic and International Management, HSE Graduate School of Business

#Cross-culturalManagement #ModernManagementTrends

MARIA DVORYASHINA

Guest lecturer, Department of Marketing, HSE Graduate School of Business

#MarketingStrategies #MarketingMetrics

APPENDIX 1

GROUP OF AEROFLOT COMPANIESAeroflot[4] is a group of three key carriers, offering customers a wide choice of solutions through its extensive route network and various carriers, ranging from the low-cost carrier Pobeda and the regional carrier Rossiya, which has the social mission of connecting the Russian regions, to the premium carrier Aeroflot.[5]

Aeroflot’s vision is to remain the uncontested leader in domestic and international air travel for Russia and be among the best airlines in the world, combining dynamic development and high reliability with quality service. The implementation of the company’s main objective is based on a system of values, such as client confidence, results for shareholders, teamwork, and social responsibility.[6] By early 2020, Aeroflot was the holder of the most prestigious international awards in the aviation industry:[7]

• “Five stars” for punctuality of flights from the British analytical agency OAG. Among those receiving the maximum score, Aeroflot was the only airline in Russia and the largest in Europe in terms of traffic volume.

• For the eighth time, Aeroflot has been named ‘Best Eastern European Airline’ by Skytrax World Airline Awards.

• Aeroflot won the two main categories in the World Travel Awards 2019 – Leading Airline Brand and Best Business Class. The airline has maintained its status as the most recognisable brand in global aviation for three consecutive years, remaining the first and only holder of this title from the World Travel Awards in history.

LUFTHANSA GROUPThe Lufthansa Group[8] is an international airline group represented by European network airlines, low-cost airlines with direct flights without connections and companies providing services to the aviation industry. The group includes Deutsche Lufthansa AG, Germany’s flagship carrier, Swiss International Airlines, Austrian Airlines, Brussels Airlines, and the low-cost carrier Eurowings.

Lufthansa Group’s main priority is to combine an attractive route network, the highest quality of service, and affordable prices in the economy segment. By investing in technology, the company aims to make its customers’ journeys more comfortable: “Passengers may not notice it, but they will feel it.”

Lufthansa Group is the founder of the Star Alliance network, which was established in 1997 as the first global airline alliance to offer international reach, recognition, and seamless service to international travellers. Its recognition by passengers has been acknowledged with numerous awards, including Air Transport World Market Leadership Award and Best Airline Alliance by Business Traveller Magazine and Skytrax.

AIR FRANCE-KLM GROUPAir France-KLM Group[9] is the world’s largest player in the air transport market and the leading group in intercontinental departures from Europe. Its core businesses are passenger transport, cargo, and airline services. The group comprises Air France, KLM Royal Dutch Airlines, Transavia, Air France KLM Martinair Cargo, and Air France Industries KLM Engineering & Maintenance. Inspired by the French spirit, the alliance is “a detail-oriented and mindful global airline, turning travel into moments of pleasure and elegance.” The Air France-KLM Group offers its passengers enhanced comfort, prioritises fuel economy and meets its commitment to sustainable development. The Group’s commitment to society and the environment is a key priority in its development, social progress and environmental friendliness. Air France-KLM is mobilising around its four key development priorities. These are reducing its environmental impact, integrating sustainability into its products and services, promoting a responsible human resources policy, and contributing to the development of the territories in which the Group operates.

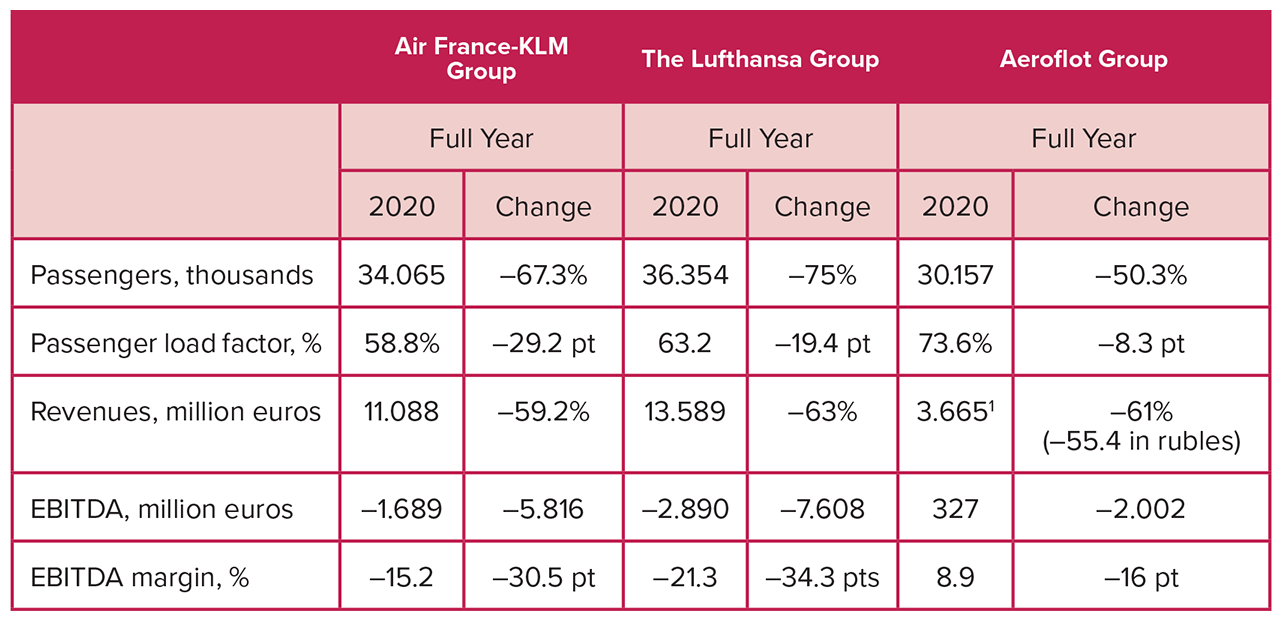

APPENDIX 2MAIN OPERATIONAL AND FINANCIAL PERFORMANCE INDICATORS IN 2020

Source: Created by authors based on annual reports of the companies for 2020.[10]

AEROFLOT: IFRS OPERATING AND FINANCIAL RESULTS FOR 6M 2020

KEY PRODUCTION INDICATORS

Source: Created by authors based on annual report of Aeroflot for 2020 https://ir.aeroflot.ru/en/reporting/annual-reports/

Case № 0012-2-1

FOOD ROAD TO YANDEX: WHAT DOES A FOOD TECH STARTUP DO TO BECOME A PART OF A NATIONAL IT GIANT?

G. Minnigaleeva, M. Maron

The case presents a typical situation an entrepreneur faces when he/she develops the business and then decides to sell it. The text reveals real-life challenges, which are quite usual for beginning entrepreneurs around the world. It is based on a story of a successful Russian foodtech startup and allows analyzing a range of questions related to strategic choices as they were evolving in real life.

The case may be used for the students of entrepreneurship at the bachelor and master levels, as well as MBAs. Depending on the students’ level, they may practice market analysis, a startup valuation, strategic decisions, or choice of strategy and materials for a pitch. The case is based on the data from field research (interviews with one of the founders) and information from open sources. Additionally to the compact case, a sincere and detailed video-interview with Sergey Polissar (co-founder) is available. The interview reveals more details about the challenges and solutions, which shaped the young company.

On a dark November night of 2017, Maxim Firsov and Sergey Polissar were still working on a presentation of their foodtech startup they had been nurturing in preparation to sell. Eventually, the Russian IT giant Yandex became interested after the endless caravan of fruitless pitches to other businesses. Yandex was a public company and the 4th most popular search system in the world in 2014 according to the number of search requests. It offered over 50 different online services and its market capitalization was at 10.73 bln dollars in 2017. Now, the question was how much this company would actually value the ideas the friends had generated over the past year.

FOOD, CLEANING OR MANICURE: WHICH VENTURE WOULD EVENTUALLY BRING MORE MONEY?

Sergey’s mind flashed back to the days when he had only been conceiving an idea of a startup. He had been the Vice President of Business development at Lamoda.ru, one of the largest Russian online clothes stores, and had been happy to realize that a good colleague and friend of his, Maxim, had also been thinking of leaving corporate life for a free-spirited entrepreneurship game. They had started searching for a promising business idea together. Sergey felt fresh and ready to discuss new business ideas with his partner after leaving Lamoda and relaxing during a month-long trip in Iran.

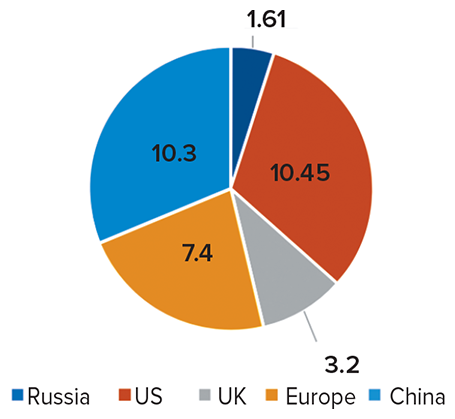

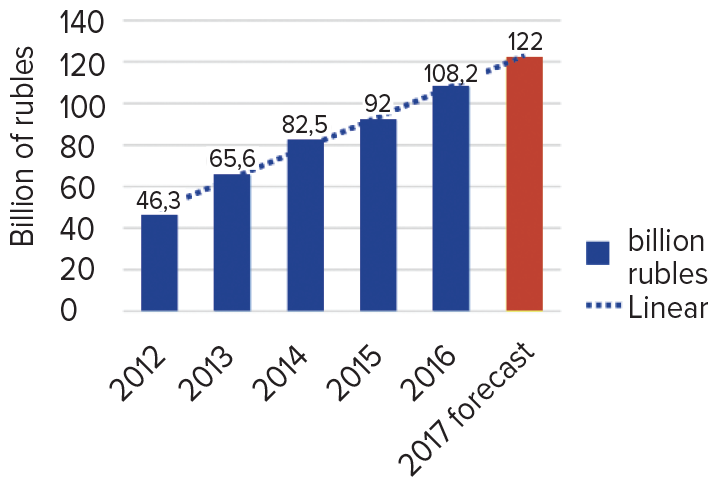

Once again, seated in Sergey’s cozy kitchen over a pizza from the next door pizzeria, they were scrolling through startup success stories in the US, UK, and China. From the very beginning they had brushed away an idea of creating a complete innovation. There were a few reasons for that. First, Russia was not a place to secure the early-stage funding easily. The institutes of business angels and venture capitalists were close to non-existent. Thus, the friends were only counting on their own resources to develop their startup and were seeking to copy a viable business model already working somewhere abroad. The services widely popular abroad but still not well represented in Russia included food delivery, cleaning, telephone repair, and manicure. Those services work on demand and mostly rely on mobile applications, which allows for a fast order and delivery of the service. The food delivery market looked the most promising market to exploit. It had grown by 2.5 times over 5 years, showing an annual growth of 20–30 %. The appeal of markets with high growth potential for seed funding strongly affected Sergey’s final decision.

Figure 1. Food delivery revenue in 2016 in billion $ in countries

Source: Created by authors based on Food Delivery Apps Usage and Revenue Statistics – 2021. https://www.xbyte.io/ food-delivery-apps-usage-and-revenue- statistics-2021.php

Figure 2. Volume of the food delivery market in Russia

Source: Created by authors based on The resumption of growth in the food delivery market // RBC. 2017. https://marketing.rbc.ru/ articles/10112/

The friends did not really like pizza, but there was hardly any other worthy choice of food to order despite the central and vibrant Moscow’s location of Sergey’s flat. They were scrutinizing the numbers, with a growing conviction and excitement that they had found their coveted idea.

SAUSAGE AND MASH, OR CAVIAR AND OYSTERS: WHICH MARKET WAS IT GOING TO BE?

About half a year later, Sergey and Maxim were relieved that they had secured more than adequate funding to support early development of their food distribution business called FoodFox. Florian Yansen and Nils Tonsen, the founders of their former employer Lamoda, readily supported the idea and provided the initial chunk of money. Also, Target Global Fund, one of the first Russian Venture Capital Funds, had also invested over five million dollars in FoodFox. The major question was should Sergey and Maxim serve the luxury food market or channel their energy and finance into establishing FoodFox delivering food to the mass market.

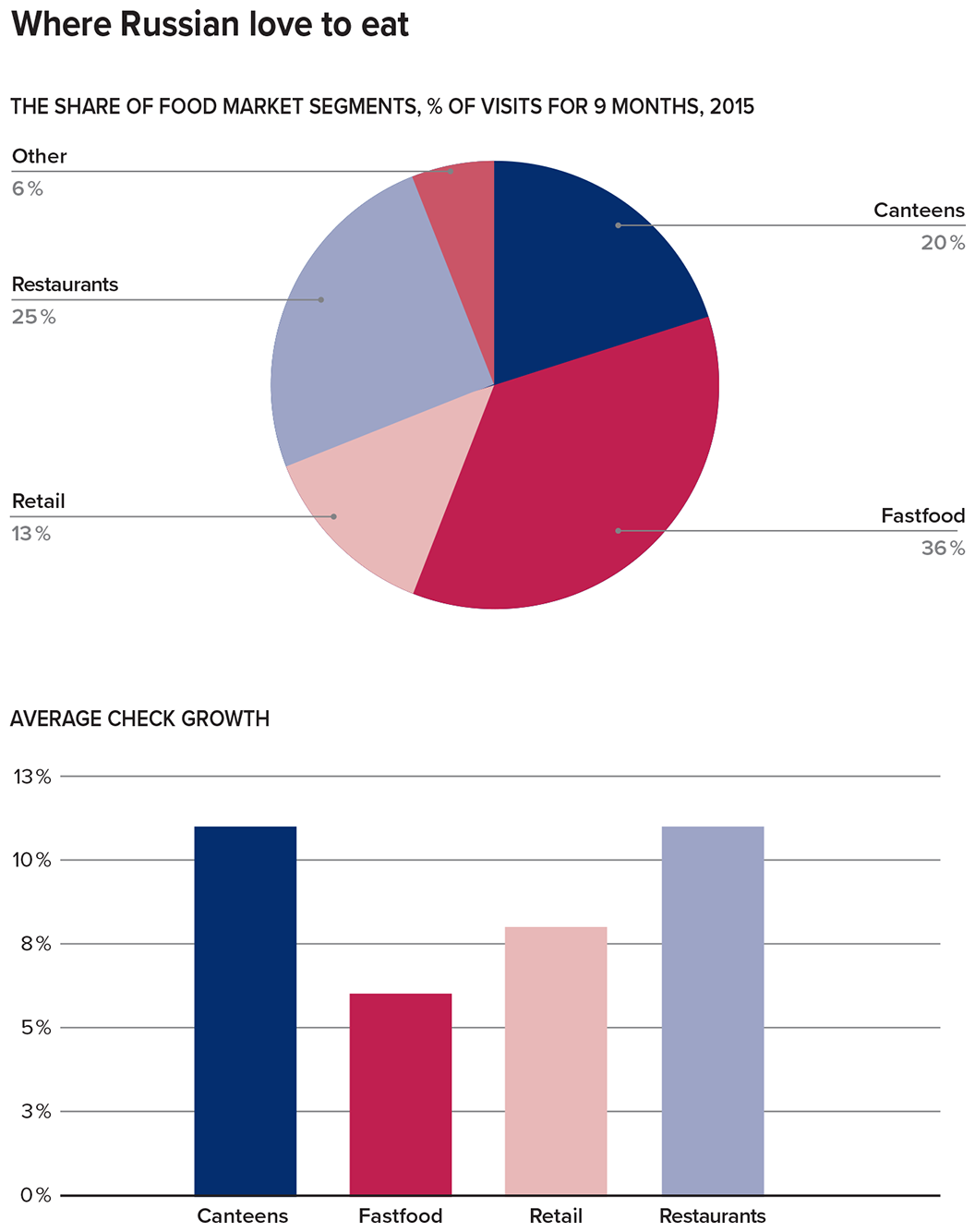

Figure 3. The share of food market segments and its average check, 2015

Source: Created by authors based on NPD Group.

The investors had already rejected the idea of food retail delivery since the business would require voluminous investments from the start and involve high risks of establishing storage and transportation systems. So, the choices were cooked meals and catering for offices, delivering from luxury restaurants or mass market.