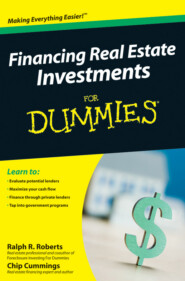

Financing Real Estate Investments For Dummies (John Wiley & Sons Limited (USD John Wiley & Sons Limited (USD)

Описание книги:

Your practical guide to scoring cash to fuel your real estate investments Want to be a smart, successful real estate investor? This no-nonsense guide contains everything you must know to make the right choices about financing your investments – from the various options available and the impact on cash flow to the tax implications and risk factors involved. You also get tried-and-true tips for surviving a down market and using current investments to finance future ones. A crash course in real estate financing – understand standard terms and concepts, learn the various sources of investment capital, and gather all essential facts and figures Weigh your options – decide which type of financing is best for your circumstances and incorporate it into your real estate investing plan Finance residential properties – evaluate residential loan programs, navigate the loan application and processing, and handle the closing Invest in commercial properties – know the different property types, choose the one that meets your investment goals, and discover unique sources for financing Tap into unconventional sources – discover the pros and cons of «hard money,» capitalize on seller financing, partner to share risk and equity, and invest on the cheap with no-money-down deals Open the book and find: Real-world advice on financing without tying up all your capital How to get prequalified or preapproved for a loan Questions to ask your lender upfront Ways to avoid common beginner blunders How to protect your personal assets from investment risks Bargain-hunting hints for low-cost loans Strategies for surviving a credit crunch Ten pre-closing steps you must take