Полная версия:

Russian business law: the essentials

Russian business law: the essentials

Edited by Evgeny Gubin and Alexander Molotnikov

Lomonosov Moscow State University Faculty of Law Business Law Department

Editors – Evgeny Gubin and Alexander Molotnikov

Cover Design – Anna Susanyan

Copyright © 2016 by ANO Startup

* * *"This work clearly explains the sources of business law in Russia and the way in which the law supports entrepreneurial activity. It will be an important tool of understanding for Western scholars and testimony to the importance given to the law as a mode of business regulation in contemporary Russia."

Professor Simon F. DeakinUniversity of Cambridge Faculty of Law"This book fills a gap in the English language literature on Russian business law. It provides an important starting point for comparative corporate law scholars and corporate lawyers by making the foundational rules on Russian business law easily accessible in English. Hopefully, this book will inspire more comparative legal research on Russian Business Law in the future."

Dr. Dan W. PuchniakAssociate Professor of Law, National University of Singapore (NUS) Director of Corporate Law, NUS Centre for Law & Business"This book demonstrates to the world the business law of Russia and may promote economic and commercial engagement between Russia and other countries. Meanwhile, the book has great significance to the international trade and investment, and economic globalization. Therefore, we really look forward to the publication of this book."

Professor Ciyun ZhuTsinghua University School of Law"The chapter on "Business Litigation" includes a useful section on the Russian judicial system, including the jurisdiction and functions of the Arbitration Courts. The chapter also looks into the arbitral tribunal system (which is not the same as the Arbitration Courts) in the Russian Federation. The chapter on "Contracts" can function as a convenient starting point for anyone seeking a comprehensive summary of the law relating to commercial and other contracts. I especially benefitted from the section on sale of goods contracts in the Russian Federation."

Professor Anselmo ReyesUniversity of Hong Kong Faculty of LawAcknowledgements

We would like to express our deepest appreciation to the Lomonosov Moscow State University Faculty of Law, especially to Dean Alexander K. Golichenkov, Deputy Dean Vladimir Stepanov-Egiyants and to all professors of the Business Law Department for their help and support during the preparation of this book.

We are grateful to Professor Stephen Sammut for preparing a great foreword to our book and to Dr. Dan W. Puchniak, Professor Ciyun Zhu, Professor Anselmo Reyes, Professor Simon F. Deakin for their endorsements.

We also greatly appreciate the support, input and inspiration to our book provided by:

Zhang Shouwen, Dean of the Peking University Law School

Michael Hor, Dean of the University of Hong Kong Faculty of Law

Simon Chesterman, Dean of the National University of Singapore Faculty of Law

Brian R. Cheffins, Professor of Corporate Law, University of Cambridge Faculty of Law, Professors of the Center for Transnational Legal Studies (London)

Nikolai I. Mikhailov, Deputy Director of the State and Law Institute of the Russian Science Academy

Dmitry Yu. Guzhelya, Deputy Head of the Russian Federal Agency for CIS Affairs, Compatriots Living Abroad and International Humanitarian Cooperation

Alexey R. Khokhlov, Deputy Principal for innovation policy management and international academic cooperation at the Lomonosov Moscow State University

www.rc-law.ru

WeChat ID: RUS-CN-LAW

We are thankful to Nickolas Grecco for reviewing the text in English language.

Finally, we are very grateful to the students of the Lomonosov Moscow State University Faculty of Law and, especially to Nikita Pyasetskiy, for their help in materials processing for this book and its editing.

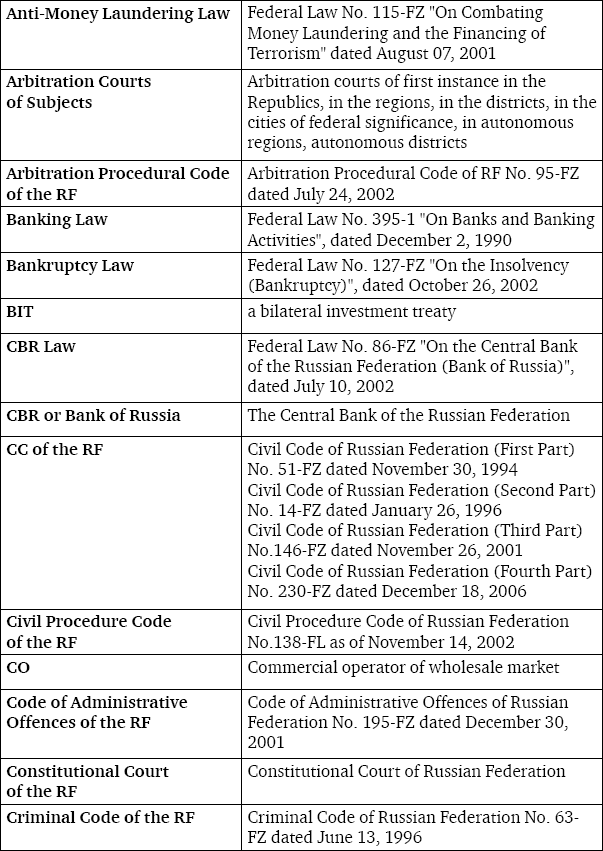

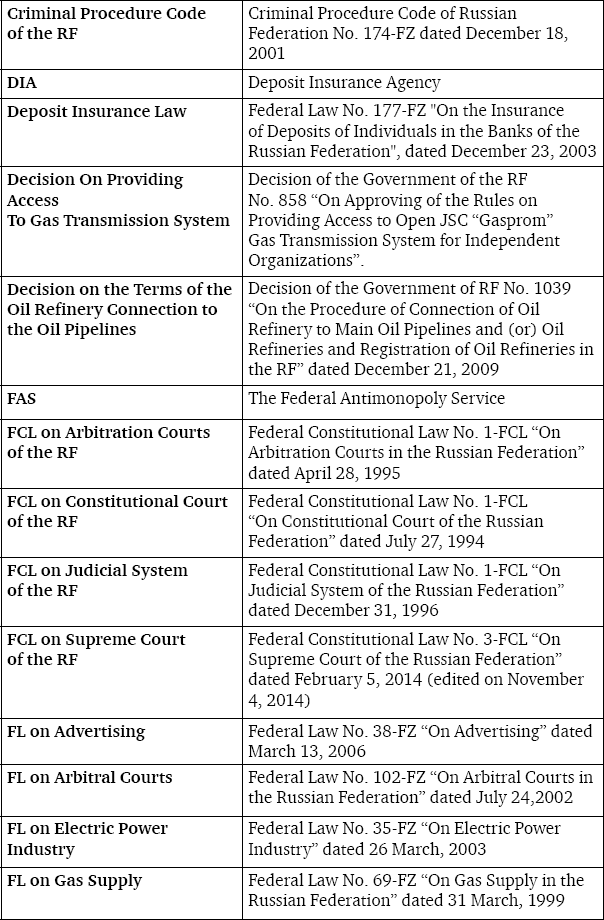

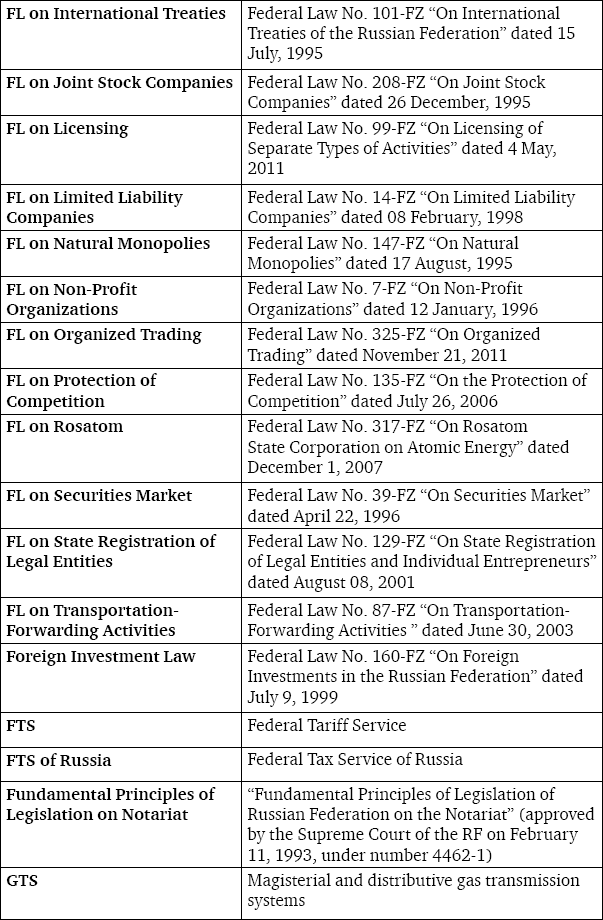

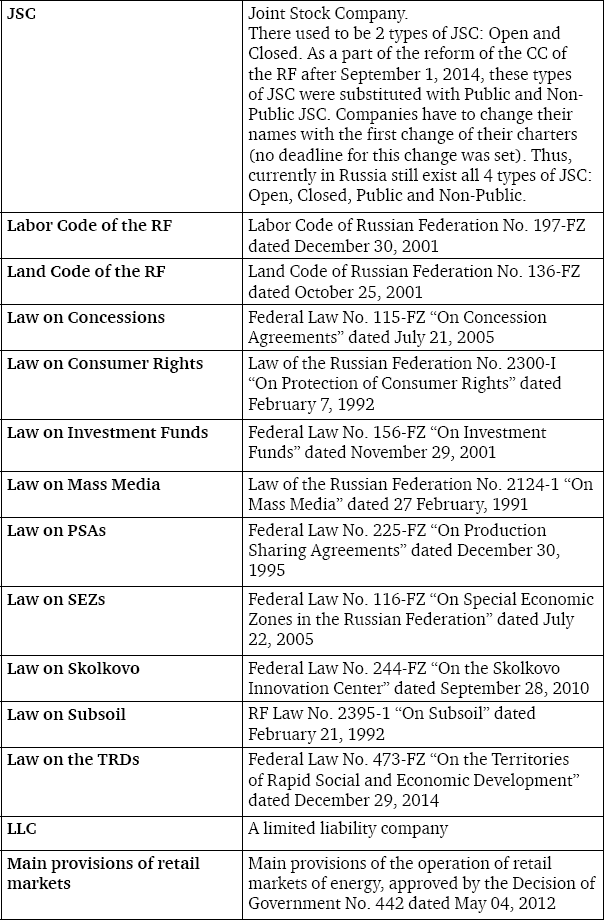

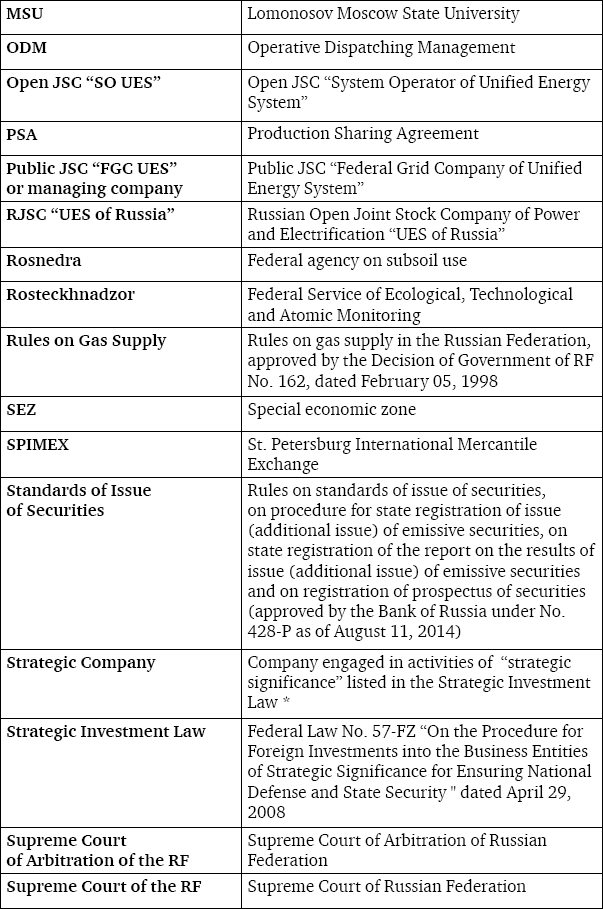

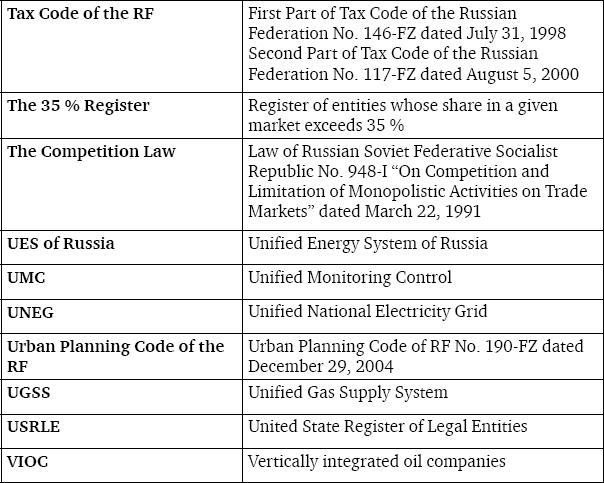

Glossary

Foreword

We’ve not had the pleasure of meeting in person, but Professors Evgeny Gubin and Alexander Molotnikov have done me a great service in assembling this thorough and readable text along with Levon Garslian, my former student at the University of Pennsylvania, who excellently managed all the book edition process and co-authored its introduction. As a teacher of “Private Equity in Emerging Markets” at the Wharton School of the University of Pennsylvania and a vocal advocate for global entrepreneurship and private sector approaches to economic development, I am often asked the question when promoting activity in a given country, “What about the rule of law?” As it relates to many countries, it is a fair question. In the case of Russia it is not. On the surface, it might seem an appropriate question but it originates from a cascade of misinformation and misunderstanding about the Russian system and an ignorance of the vast progress that has been made since the Russian Federation was established just a quarter-century ago. Every question, of course, is a statement. The Russian rule of law question is indicative of a reluctance to invest within Russia or collaborate with a Russian company. This reticence is born not of experience, but from past echoes of geopolitical tensions and misguided assumptions about how Russia administers business law and adjudicates legal conflicts between parties, perhaps reinforced by prevailing international concerns. This book provides any individual or company with the insights necessary to do business in Russia on a foundation of knowledge and with confidence that a sophisticated system of commercial justice will apply.

The book is rich in examples that support my enthusiasm. For example, the overview of business legislation chapter successfully guides the reader through how Russia’s Continental legal tradition is driven by statutes and how these statutes are assembled as a hierarchy reflecting the principles of law at the federal level and, then, the regional level. The authors describe the system for originating, testing and promulgating law in a way that suggests society-wide consideration of the principles and their application. Enlightening to me is the discussion of the Constitutional basis for the oversight, and essentially promotion, of entrepreneurship. Few countries originate sets of laws out of specific consideration of the need to drive entrepreneurial activity by providing a set of statutes to serve as a guide on the one hand, and a set of assurances on the other. In fact, Russian law assembles in definable provisions a suite of identifiable statutes addressing a vast array of circumstances and possibilities.

It appears to me as a foreigner that Russia has successfully sought to leapfrog its system of commercially related laws through careful study, analysis and adoption of the experiences of countries under the Continental legal tradition, as well as the British-American tradition. As such, while there are specific differences, foreign business people will find the underpinnings of modern Russian law intuitive with respect to the traditions of their native countries. This is not to suggest that there are not differences, but to assure readers that there is an internal logic to Russian law that is rooted in the practical experiences of countries with longer capitalist heritages.

As a practical guide, the book provides the information necessary to distinguish the individual and entities with legal standing. In addition, the book provides a comprehensive view of the available legal structures for profit and nonprofit organizations in detail that is sufficient for the lay reader to understand the options, and discuss these knowledgeably with competent legal counsel. Attorneys tell us that the best clients are informed clients. With respect to the choice of entity, any reader will be an informed reader and can make the most of their relationship with legal counsel.

I found the discussion of Russian Securities Laws and Regulations particularly enlightening. Here again, it is obvious that modern Russian law has leapfrogged over a century’s worth of missteps in the evolution and enforcement of securities laws in other countries. It has done so for a wide-variety of financial instruments and products. While Russia has its own complexities and special requirements in this arena, the book presents the overall structure in an understandable way that inspires confidence. There is a clear message that there are severe penalties for stepping outside the regulations. From that I infer that the Russian government is serious about building and maintaining confidence in its capital markets.

The book also offers a concise but thorough discussion of the Constitutional basis for litigation, arbitration and other means of legal protection. In any jurisdiction, this aspect of law represents a maze of due process and procedure that is mastered only by the most dedicated and diligent legal practitioner. Here again, however, the notion that the best client is an informed client applies.

This chapter should be read and digested by any business person contemplating commercial activity in Russia as a means of deriving confidence in the Russian legal system on the one hand, and as a guide for enhancing their negotiation of business terms in a contract. Too often, business people will leave the legal provisions to attorneys without taking the time to arm themselves with insights that will allow them to craft an investment or business relationship that considers the universe of issues. The book’s accessible treatment of protections is a must read for anyone venturing in Russia or into Russia for the first time.

Finally, in every jurisdiction in every country, whether national, regional or local, there are principles of contract law that have their own nuances when applied in negotiation, commercial activity and adjudication. While these are, again, the province of a dedicated jurist, the book provides a valuable oversight into the realities of contract law in Russia and in so doing, arms the lay reader with the information and insights necessary to structure the most satisfactory investment or commercial relationship.

As I said in my opening paragraph, Levon Garslian and Professors Gubin and Molotnikov have done me a great service. Now when I am asked about the rule of business law in Russia, I can honestly reply “Read Russian Business Law: The Essentials” and you will have your answer.

Stephen M. Sammut,Senior Fellow, Health Care Management Lecturer,Entrepreneurship Wharton School, University of Pennsylvania,December 20, 2015Preface

“You will not grasp her with your mindOr cover with a common label,For Russia is one of a kind —Believe in her, if you are able…”[1]Fyodor Tyutchev[2] (November 28, 1866)These insightful and, in some way, mysterious words, written by F. Tyutchev almost more than 150 years ago, could be also applied today to various spheres of the Russian life. This could even be applied to the way we do business or so-called “entrepreneurship.” Furthermore, it seems that one could have such a perception not only in relation to doing business, but also the law around it. Our attempt here is to show that this is not the case. Certainly, Russian law, especially business law, could hardly be covered “with a common label;” if anything related to Russia could be done so at all. However, you can definitely “grasp” the Russian business law “with your mind,” at a high-level, even without having a legal background. Our main goal is to help you to achieve such an understanding.

The study of business law is an essential requirement for a business lawyer, businesspersons (including managers and entrepreneurs), as well as for academics. Consider this – what would you do if (1) your client or company has a legal issue in Russia, or (2) you want to tell your students about recent law developments in business transactions in Russia, or (3) you are simply interested in learning about the new Russian law system regulating business relations and conditions of the market economy? Whom would you ask, or where would you look up first? Answers may vary according to the situation: one could hire a law firm, call a friend, or just “google” it. However, it would be much more convenient to have something to use that is reliable, concise, and comprehensive. The absence of a helpful resource in English encouraged our team mainly of professors, PhD students, and graduates of the Lomonosov Moscow State University Business Law Department to prepare this book, which tells about the regulation of business in Russia. However, one should not consider that its main purpose is to simply retell the content of legal acts related to the regulation of business relations. Our team strove to resolve a much more complex problem: on the one hand, to show in what way particular areas of business are regulated, and on the other, to define the fundamentals of business regulation in Russia.

This book covers the following areas of the Russian business law:

1. Business Legislation

2. Business Association Forms

3. Core Business Contracts

4. Securities Regulation

5. Banking Regulation

6. Competition

7. Bankruptcy

8. Regulation of Natural Resources

9. Investment Regulation

10. Business Litigation, Arbitration and Other Remedies

Thus, this book provides a comprehensive overview of the ten core areas of Russian business law; in other words, its essentials.

Prof. Dr. Evgeny P. Gubin,Head of Business Law Department Faculty of Law,Lomonosov Moscow State University,Moscow, January, 2016Alexander Molotnikov,PhD, Associate Professor at Business Law Department,Faculty of Law, Lomonosov Moscow State University,Moscow, January, 2016Alexander Molotnikov,[3] Levon Garslian,[4] Andrei Gabov[5]

Introduction to Business Law in Russia

Before getting too deep into regulatory details, it seems appropriate and necessary to give a concise historical and conceptual background of Russian business and business law, in order to enable our reader to better understand the current developments.

1. Entrepreneurship Revival

For almost 70 years[6] during the existence of the USSR, entrepreneurship was impossible and even illegal. The key feature of the economy in the Soviet period was the "leading role" of the Communist Party. The Soviet economic system had to comply with the principles that the Party proclaimed: one-party leadership, planned economy, state ownership, and high rates of accumulation. To uphold these principals, the use of non-economic coercion could be possible. Thus, the Soviet economy itself was like one large corporation owned by the state and managed by the Communist Party. Only after the fall of the Soviet Union in late 1991 and the transition to the free market economy, one could start thinking about doing business.

The first legal developments towards the revival of entrepreneurship in the Soviet Union took place even earlier, and are related to the passing of such laws of the USSR as "On individual labor activity" (1986), "On cooperation in the USSR" (1988), and "On general fundamentals of citizen entrepreneurship in the USSR" (1991). Entrepreneurship received the most developed legal regulation in legislation of the Russian Federation – in laws of the RSFSR "On companies and enterprise" (1990), "On registration fee for natural persons carrying out entrepreneurship and a procedure of their registration" (1991), “On property in the RSFSR” (1990), the Constitution of 1993, and the Civil Code of the RF.

For a revival of entrepreneurship in the Russian Federation, one had to create corresponding economic-legal prerequisites. They were created stage-by-stage via reformation of the economic system at the legislative level. The core change related to the transformation of property ownership. In conditions of a socialist property domination, where state ownership constituted the basis of the economic system of the USSR. With this form of socialist property,[7] the revival and development of entrepreneurship was simply impossible, due to a lack of proprietary forms’ variety, lack of private property, a lack of a market and its participants, and competition.

A new approach to a system of forms of ownership that developed in our country was expressed by passing the law of the USSR of March 6, 1990, "On property in the USSR," and by passing respective version of the Constitution of the USSR. The law of the USSR "On property in the USSR," (article 2.1.) for the first time directly permitted all the owners and so, even citizens to use property belonging to them for any economical or other activity not prohibited by a law. Furthermore, in combination with the right to use the labor of other citizens during exercise of property rights (article 1, paragraph 4), this law essentially opened a way to a revival of entrepreneurship.

Therefore, the adoption of the law of the USSR, "On General Fundamentals of Citizen Entrepreneurship in the USSR," seems very appropriate. Enterprises, buildings, equipment, and other means of production, and any other property have become the objects of the private property.

In the Russian Federation, the Law of the RSFSR of December 24, 1990, "On Property in the RSFSR" in art. 2, paragraph 3, the right of private, state, municipal ownership, as well as of ownership of public associations (organizations) were enshrined. This was the fundamental law which regulated ownership in this period.

The Constitution of 1993 RF recognized and protected in an equal way private, state, municipal and other forms of ownership (part 2 of art. 8); in the Russian Federation, “land and other natural resources can be in a private, state, municipal and other forms of ownership” (part 2 of art. 9).

This provision has been developed in the Civil Code RF, article 18, which is devoted to the legal capacity of citizens, granting them the right "to own the property… to carry out business and other activities not prohibited by laws; create legal entities on their own or together with other citizens and legal entities; conduct any transactions not prohibited by laws." Hence, the Civil Code of the RF includes the key condition of entrepreneurship – the right to carry out business activity. Freedom of labor is another indispensable condition of entrepreneurship, granted by the Constitution of the RF (art. 37).

Thus, by the beginning of the 1990s, the following fundamental conditions, necessary for the existence and development of entrepreneurship, were provided: (1) variety of proprietary ownership (first of all, private property); (2) right to carry out business activity; and (3) freedom of labor.

2. Economic Environment

One could think that after getting the necessary legal capacity for doing business in the early 1990s, nothing else was required for the development of entrepreneurship. In theory, this might be true, but of course, not in practice. The stability and strength of the national economy are the key drivers for the development of business, especially at a starting point. With regard to this, it is important to keep in mind that, in 1991, Russia was just getting into the complex process of transitioning to the market economy.

In the 1990s, the Russian economy experienced a deep recession, accompanied by extremely high inflation, low level of investment, growth of external debt, increase of barters, and many other negative processes. To improve the situation, a series of economic reforms took place, including the liberalization of prices and foreign trade, mass privatization, and other reforms. Nonetheless, in August 1998, Russia announced a default on its state obligations, and refused to support the ruble; in other words, the macroeconomic policy pursued since 1992 had failed.

During the 2000s, another series of reforms, this time with a positive effect, were made in various spheres, inter alia: (1) tax; (2) pension; (3) banking; (4) electricity; (5) railway. Even foreign experts at that time noticed the effectiveness of the reformation processes initiated by President Putin. For instance, the reform of the taxation system was considered a key factor of the economic growth.[8] All these processes resulted in Russia finishing the year of 2007 as the seventh largest economy in the world, ahead of Italy and France.[9]

In the late 2000s, Russia experienced a situation that affected many other countries – the financial crisis of 2008, and the ensuing recovery. In March 2010, the World Bank report noted that the losses of the Russian economy were lower than expected at the beginning of the crisis, due to effective anti-crisis measures taken by the government.[10] However, the period of stability after the recovery from the financial crisis did not last long.

Since the beginning of 2014, the economy has been in stagnation. The outflow of capital from Russia in 2014 amounted to a record $151.5 billion.[11] Moreover, the Russian ruble experienced significant fluctuations and even collapsed against Euro and the US dollar. There were several reasons for this, but the primary reasons were low oil prices, and a political crisis in relations with Ukraine, followed by mass economic sanctions from the US and the EU.

This brief description of the Russian economy development shows that in the last 25 years, the longest period of the economic stability was less than 5 years. Thus, entrepreneurship, being dependent on the overall economic conditions in the country, has always faced challenges during its development.

3. Business Law Evolution

After a brief historical background on the economy and entrepreneurship development in Russia, it is important to become familiarized with the evolution of Russian business law as a science.

The study of the Russian business law originated in the works of the most eminent Russian legal academics of the 18–19th centuries, who connected their lives with MSU. For instance, D. Ushinskiy, an MSU graduate, was the first person who argued for the necessity of defining business law as an independent branch of law. This was a crucial statement for the Russian legal tradition, where the division of law into different branches (areas) was important. This branch system continues to this day, and the reasons including the following: first, each legal scholar focuses his/her research on a specific area of law. The structure of law faculties at Russian universities is based on such a division of law. In 1876, professor N. Nersesov established a department of trade law at MSU, for the purposes of research in the area of business regulation.