Полная версия:

Ultimate guide on GCC Taxation

Pavel I. Gerasimov

Ultimate guide on GCC Taxation

© Pavel I. Gerasimov 2023

SAUDI ARABIA

OVERVIEW

Saudi Arabia, located in the Middle East between the Arabian Gulf and the Red Sea, is the birthplace of Islam and home to Islam’s two holiest shrines, in Makkah and Madinah. The modern Saudi state was founded in 1932 after a 30-year campaign to unify most of the Arabian Peninsula. Saudi Arabia is divided into 13 provinces, with Riyadh as the capital. The official language of Saudi Arabia is Arabic, and the currency is the Saudi riyal (SAR).

The country is a leading producer of oil and natural gas. The government continues to pursue economic reform and diversification, particularly since Saudi Arabia’s accession to the World Trade Organization (WTO) in December 2005, and promote foreign investment. A burgeoning population, aquifer depletion, and an economy largely dependent on petroleum output and prices are all ongoing governmental concerns.

Saudi Arabia possesses about 20 % of the world’s proven petroleum reserves, ranks as the largest exporter of petroleum, and plays a leading role in the Organization of Petroleum Exporting Countries (OPEC).

In April 2016, Saudi Arabia introduced the Vision 2030 plan to reduce its dependence on oil, diversify the economy, and develop service sectors, such as health, education, infrastructure construction, recreation and tourism, and many more. The sweeping reforms outlined in the Vision 2030 and National Transformation Plan affect vast areas of the government, the economy, and citizens. Tax policy will play a significant role in these reforms as part of the government’s efforts to diversify revenues away from oil and address broader social and economic objectives while maintaining a fertile business environment and continuing to attract foreign direct investment (FDI).

One of the key targets of Vision 2030 is to increase FDI to 5.7 % of gross domestic product (GDP) by 2030, from 3.8 %. There is a large pool of research demonstrating the positive impact that double taxation treaties (DTTs) can have on FDI flows. Saudi Arabia should consider DTTs as a keyway of attracting foreign firms into the Kingdom by offering them the reassurance that income will not be taxed twice. DTTs already prevail over domestic tax rules, and over 50 have been signed with countries including the United Kingdom, China, Switzerland, and Japan. The next step should be to focus on other key trading partners, particularly the United States, but also Germany and Australia.

Furthermore, Saudi Arabia is encouraging the growth of the private sector in order to diversify its economy and to employ more Saudi nationals. Diversification efforts are focusing on power generation, telecommunications, natural gas exploration, and petrochemical sectors. Roughly 10 million foreign workers play an important role in the Saudi economy, particularly in the oil and service sectors.

CORPORATE – TAXES ON CORPORATE INCOME

Generally, non-Saudi investors are liable for income tax in Saudi Arabia. In most cases, Saudi citizen investors (and citizens of the GCC countries, who are considered to be Saudi citizens for Saudi tax purposes) are liable for Zakat, an Islamic assessment. Where a company is owned by both Saudi and non-Saudi interests, the portion of taxable income attributable to the non-Saudi interest is subject to income tax, and the Saudi share goes into the basis on which Zakat is assessed.

According to the income tax law, the following persons are subject to income tax:

● A resident capital company with respect to shares owned either directly or indirectly by non-Saudi / non-GCC persons and persons operating in oil and hydrocarbon production, except for the following (in which case the underlying resident company would be subject to Zakat:

● Shares owned in a resident capital company listed in the Saudi stock market acquired for the purpose of speculation through trading in the Saudi capital market.

○ Shares owned either directly or indirectly by persons working in the field of oil and hydrocarbons production in a resident capital company listed in the Saudi stock market, and the shares owned either directly or indirectly by these companies in capital companies.

● A resident non-Saudi natural person who carries on activities in Saudi Arabia.

● A non-resident person who carries out activities in Saudi Arabia through a PE.

● A non-resident person who has other income subject to tax from sources within Saudi Arabia without having a PE.

● A person engaged in natural gas investment fields.

● A person engaged in oil and other hydrocarbon production.

The rate of income tax is 20 % of the net adjusted profits. WHT rates are between 5 % and 20 %. Zakat is charged on the company’s Zakat base at 2.5 %. Zakat base represents the net worth of the entity as calculated for Zakat purposes.

It should be noted that, although the income tax rate is 20 %, income from the following two activities is subject to different rates:

● Income from oil and hydrocarbon production is subject to tax at a rate ranging from 50 % to 85 %.

● The tax base of a person who works in natural gas investment should be independent of the tax base relating to other activities of this person.

Effective 1 January 2018, the income tax legislation was amended to repeal the Natural Gas Investment Tax (NGIT) provisions; natural gas investment should be taxed under the general provisions of the income tax legislation (including being subject to the general income tax rate of 20 %).

CORPORATE – CORPORATE RESIDENCE

A company is considered a resident company if it is formed under the Saudi Arabian Regulations for Companies or if its central management is located in Saudi Arabia.

PERMANENT ESTABLISHMENT (PE)

According to the Saudi tax regulations, the following are the requirements for considering a non-resident party to have a PE:

● A PE of a non-resident in Saudi Arabia, unless otherwise provided below, consists of the permanent place of activity of the non-resident through which one carries out business, in full or in part, including business carried out through an agent.

● The following are considered a PE:

● Construction sites, assembly facilities, and the exercise of related supervisory activities.

○ Installations or sites used for surveying for natural resources, drilling equipment, or ships used for surveying for natural resources, and the exercise of related supervisory activities.

○ A fixed location where a non-resident natural person carries out business.

○ A branch of a non-resident company that is licensed to carry out business in Saudi Arabia.

● A place is not considered a PE of a non-resident in Saudi Arabia if it is used in Saudi Arabia only to do the following:

● Store, display, or deliver goods or products belonging to the non-resident.

○ Keep an inventory of goods or products belonging to the non-resident only for the purposes of processing by another person.

○ Purchase goods or products only for the collection of information for the non-resident.

○ Perform any other activities that are preparatory or auxiliary in nature for the interests of the non-resident.

○ Prepare contracts relating to loans, supply of products, or perform technical services for signature.

○ Execute any group of the activities mentioned above.

● A non-resident partner in a resident personal company is considered an owner to a PE in Saudi Arabia in the form of a share in a personal company.

Furthermore, the agent mentioned in the above article is identified as a dependent agent who has any of the following authorities:

● Negotiate on behalf of a non-resident.

● Conclude contracts on behalf of a non-resident.

● Has a stock of goods, owned by a non-resident, on hand in Saudi Arabia to supply the clients’ demands regularly on behalf of the non-resident.

A place from which a non-resident carries out insurance and/or reinsurance activity in Saudi Arabia through an agent is considered a PE of the non-resident even though the agent is not authorised to negotiate and conclude contracts on behalf of the non-resident.

CORPORATE – OTHER TAXES

VALUE-ADDED TAX (VAT) AND EXCISE TAX

VAT Law and implementing regulations have been published and are applicable from 1 January 2018.

VAT is imposed at a rate of 5 % for most goods and services, with certain exceptions applicable. Effective 1 July 2020, the standard VAT rate was increased by the government to 15 %.

The Excise Tax Law became effective on 11 June 2017 in Saudi Arabia, with only tobacco products (at 100 %), soft drinks (at 50 %), and energy drinks (at 100 %) selected as goods subject to the excise tax in Saudi Arabia.

In order to comply with the Saudi Arabian Excise Tax Law, manufacturers and importers of excisable goods are required to register with the GAZT. Businesses that qualify to be under the scope of the Excise Tax Law that fail to register and comply with the guidance issued by the GAZT will be considered as tax evaders and will be imposed penalties.

CUSTOMS DUTIES

Customs duties are imposed on imports according to tariff rates that are effective on the payment date in accordance with the Saudi Customs regulations. Customs duties are imposed on the price of the imported goods. This price is assessed based on the actual cost paid or on the agreed upon cost denominated in the currency of the exporting country. The price consists of the price of the imported goods as packed for shipping from the port of export plus freight and insurance cost to the Saudi port, which is converted to Saudi riyals at the exchange rates published by the Saudi Central Bank (SAMA) on the date of the declaration. In case this procedure is not achievable, the imported goods will be priced based on the most proximate comparable value that could be ascertained. Imported goods that are subject to customs duties based on weight are assessed based on the gross weight or the net weight as shown in the tariff schedules. The gross weight of the goods includes the goods weight, including all internal and external packing materials. Net weight of the goods excludes all internal and external packing materials, including the items used for separating and arranging the goods.

To encourage joint ventures in manufacturing, the government grants tariff protection from competing imports to locally produced, quality goods. Rates can be as high as 25 %.

Penalties on smuggling goods vary from confiscation to collections of customs duties and penalties to imprisonment.

PAYROLL TAXES

Since there is no individual income tax regime in Saudi Arabia, earnings from employment are not subject to income tax. Only the social insurance tax is applied on the payroll.

SOCIAL INSURANCE TAX

Social insurance tax is paid monthly based on (i) basic wage, (ii) cash or in-kind housing allowance, and (iii) commissions, with an upper limit of 45,000 Saudi riyals (SAR), is computed at 2 % for non-Saudi employees, and is paid by the employer. For Saudi employees, the rate is 21.5 % and is paid by both the employee (9.75 %) and the employer (11.75 %).

REAL ESTATE TRANSACTION TAX (RETT)

RETT is imposed at a rate of 5 % of the total real estate disposal value regardless of its condition, shape, or use at the time of the disposal.

This includes the land and what is being constructed or built on it, whether the disposal occurred on this land at its current state or after an establishment was built on it, irrespective of whether the entire property was disposed of or only a part of it such as a detachment, a communal, a residential unit, or any other types of real estate, and whether the disposal was authenticated or not.

RETT also applies on transfer of real estate rich entities (as defined for RETT purposes).

The rules provide for certain exemptions that could be available in certain cases.

OTHER TAXES

There is no form of stamp duty, transfer, sales, turnover, or production taxation, except in so far as they may fall within the scope of Zakat, which is applicable only to Saudi nationals.

CORPORATE – BRANCH INCOME

Taxable income from a branch of a non-Saudi based corporation is taxed at 20 %. Certain charges incurred by the headquarters are not deductible in the branch tax return.

CORPORATE – INCOME DETERMINATION

INVENTORY VALUATION

The weighted average-cost method is used for valuing inventory under Saudi tax law.

CAPITAL GAINS

Capital gains are subject to income tax or Zakat, as appropriate, at the normal income tax or Zakat rate. However, capital gains realised from the disposal of shares in Saudi stock companies listed in the Saudi market are tax exempt, subject to certain conditions.

DIVIDEND INCOME

Dividend income that is received by a resident party is subject to income tax at the normal income tax rate unless exempt. Dividends can be exempt from income tax in Saudi Arabia if the following conditions are met, generally:

● The percentage of ownership in the company invested in is not less than 10 %.

● The period of ownership of shares is not less than one year.

Dividends paid by resident entities to a non-resident party are subject to WHT at 5 %.

INTEREST INCOME

Interest income is subject to income tax at the normal income tax rate. Interest paid to a non-resident party is subject to WHT at 5 %.

ROYALTY INCOME

Royalty income is subject to tax at the normal income tax rate. Royalties paid to a non-resident party are subject to WHT at 15 %.

Royalty is defined as per article one of the Saudi income tax law as follows:

“Payments received for use of or the right to use intellectual rights, including, but not limited to, copyright, patents, designs, industrial secrets, trademarks and trade names, know-how, trade secrets, business, goodwill, and payments received against the use of information related to industrial, commercial, or scientific expertise, or against granting the right to exploit natural and mineral resources.”

IMPORTS AND SUPPLY CONTRACTS

Saudi tax law provides that no profit will be considered to arise from a contract for the supply of goods to Saudi Arabia, provided delivery of the goods is either free on board (FOB) or cost, insurance, and freight (CIF) to a Saudi port. However, should the contract provide for the delivery and/or installation of materials at a point inside Saudi Arabia, the supplier may be considered to be carrying on business within Saudi Arabia, and, as a consequence, the contract may be subject to Saudi income taxation as follows:

● If the material cost was identified in the supply contract separately from the cost of work performed in Saudi Arabia, then, in the absence of a PE, a WHT on the work that will be performed in Saudi Arabia may be assessed, based on the type of services. However, if the contract qualifies the supplier to have a PE in Saudi Arabia, then income tax will be applied according to the Saudi tax regulations as for a normal taxpayer.

● If the supply contract indicates a total cost without segregation in the value of supply and the value of the other activities in Saudi Arabia, then the work performed in Saudi Arabia will be assigned a value equal to 10 % of the contract value for each type of activity.

FOREIGN INCOME

The gross income derived by a capital company resident in Saudi Arabia from its operations and of its branches inside and outside Saudi Arabia is subject to tax in Saudi Arabia. However, in order to avoid double taxation on the same income, the following exceptions and clarifications are to be considered:

● With respect to the income realised from investments in other resident capital companies and foreign capital companies (foreign dividends applicable from 1 January 2018) and in order to avoid double taxation, such income is to be excluded from being subject to tax under the following conditions:

○ The percentage of ownership in the company invested in is not less than 10 %.

○ The period of ownership of shares is not less than one year.

Previously (up to 31 December 2017), foreign dividends were taxable unless a DTT provided relief.

There are no restrictions on repatriation of profits, fees, capital, salaries, or other monies.

CORPORATE – DEDUCTIONS

All expenses that are necessary and normal to the business, paid or accrued, are allowable deductions, provided the expense meets the following conditions:

● It is an actual expense, supported by a verifiable document or other qualifying evidence.

● It is related to the generation of taxable income.

● It is related to the subject tax year.

● It is of a non-capital nature.

DEPRECIATION

A depreciation deduction is allowed under the following limitations as stipulated by the law:

● The asset is not intended for resale and is to be used, in full or in part, for the entity’s purposes.

● The asset is of a depreciable nature that loses value because of use or because of wear and tear and obsolescence and has a value extending beyond the end of the taxable year.

● The asset is owned by the business, as per the ownership document for buildings and contracts and invoices for other assets.

● The asset depreciation is allowed even if the asset becomes inactive during the tax year.

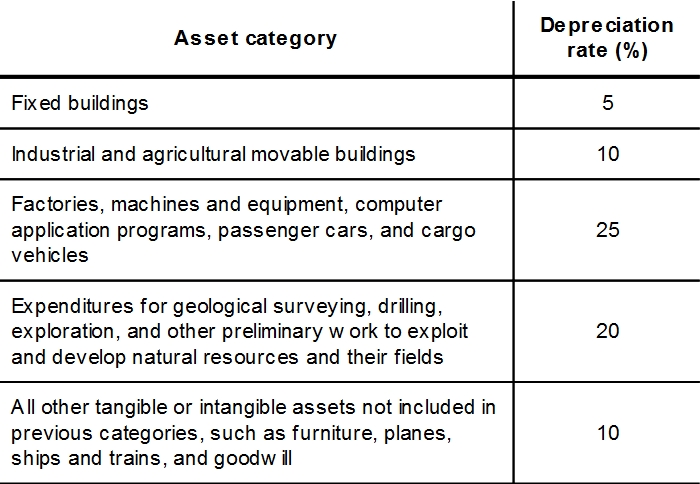

Depreciation for tax purposes is calculated as follows, based on the following five categories of depreciable tangible or intangible assets, other than land:

The declining-balance method of depreciation, according to the above rates, should be followed for tax purposes. However, straight-line depreciation is allowed for Zakat payers as per Zakat regulations.

There are also rules for depreciation relating to assets either acquired or disposed of. Essentially, 50 % of the allowable acquisition price or disposal proceeds is added to or subtracted from the asset pool in the first year, and the remaining 50 % in the following year.

From 1 January 2018, the cost base of assets transferred or distributed between companies that are part of the same group should be set at the net book value.

Assets under build, own, and transfer (BOT) and build, own, operate, and transfer (BOOT) are allowed to be depreciated over the contract period. This presumes, although it is not clear, that assets under the BOT and BOOT schemes actually will have a separate grouping in addition to the above prescribed groups.

START-UP EXPENSES

Tax treatment of start-up expenses depend on how they were treated under Saudi generally accepted accounting principles (GAAP). Generally, they can be fully expensed in the first financial year or can be capitalised and amortised.

LOAN CHARGES (INTEREST EXPENSES)

An interest deduction is limited to the lower of the loan charge incurred during the tax year, if related to income that is subject to tax, or the result of the following formula, whichever is less.

The taxpayer’s total income from loan charges, plus 50 % of (A minus B) as below:

A = income subject to tax other than income from loan charges.

B = expenses allowed under the law other than loan charge expenses.

Note that banks are not subject to this formula.

BAD DEBT

Bad debts are deductible, provided they meet all of the following conditions:

● The bad debt was previously declared in the appropriate year’s income.

● The debt resulted from sale of goods or services.

● The company holds a certificate from the taxpayer’s certified public accountant (CPA) certifying that the debt has been written off in the taxpayer’s books and records, based on a decision by the taxpayer at the appropriate management level.

● Serious efforts have been exerted by the taxpayer to collect the debt with no success and the inability of the debtor to pay has been proved based on a judicial ruling or bankruptcy.

● The debt is not from a related party.

● There is a commitment by the taxpayer to reinstate, as income, any written-off debt whenever collected.

CHARITABLE CONTRIBUTIONS

In determining the tax base of each taxpayer, a deduction is allowed for donations paid during the taxable year to public agencies or philanthropic societies licensed in Saudi Arabia, which are non-profit organisations and are allowed to receive donations.

ALLOCATIONS AND RESERVES

Allocations and reserves formed during the year are deductible as follows:

● Bank allocations to a reserve fund for doubtful debts are allowable deductions. However, a bank must submit a certificate from the SAMA stating the amount of doubtful debts and the amount of doubtful debts collected during the year that should be reinstated in the tax base of the year of collection.

● Insurance/reinsurance companies may deduct, based on industry standards, a reserve for unearned premiums and for unexpired risks, provided that it is reported in the tax base of the following year. A reserve for unearned premiums means a part of premium amounts collected or stated in books that covers risks related to the future tax year(s). A reserve for unexpired risks mean the amount of compensation claimed or reported, but for which the payment process falls short of completion during the tax year.

● A taxpayer may reduce its book profit by the amount of reserves used during the year that had been readjusted when made to increase income or decrease expenses in the year of formation. Examples of such reserves are end-of-service awards, doubtful debt, and drops in prices. Such amounts are deductible, provided the following conditions are met:

○ The used amount was paid or accrued during the year, and it is supported by documentation.

○ The reserve had been adjusted in the year of formation to increase the tax base.

SCHOOL FEES

School fees paid by taxpayers for their employees’ children are deductible expenses, provided they meet the following conditions:

● They are paid to a local licensed school.

● This benefit is stated in the employment contract.

PENSION FUND

Employers’ contributions to employees’ pension funds or savings funds established under Saudi Arabia’s rules and regulations are deductible, provided that such contribution, one payment or in aggregate, is not in excess of 25 % of the employee’s income before the employer’s contributions and that the fund meets the following criteria:

● The fund is established according to special provisions that clearly stipulate conditions of subscription and rights of subscribers.

● Such obligation is stated in the employment contract or in the Articles of Association of the establishment.

● The fund has a character independent of the establishment and has separate accounts audited by an independent CPA.

A capital company is allowed to deduct its contribution to a retirement fund, a social insurance fund, or any other fund established for the purpose of settling employee end-of-service benefits or to meet staff medical expenses, provided they meet certain conditions. It should be noted that there is a notification requirement to the GAZT in order to claim any deduction of the contribution.

RESEARCH AND DEVELOPMENT (R&D)

A deduction is allowed for R&D expenditure incurred during the tax year in connection with the generation of income that is subject to tax. Such expenditure relates to technical, scientific, and engineering experiments; computer systems; or similar research. This provision does not apply to the acquisition of land and facilities, or to equipment used for research. Such facilities and equipment are subject to depreciation under the law.